FTX crypto company is going to file for bankruptcy. According to reports the FTX crypto trading company “Earn to give” is out of business after the resignation of its CEO. The CEO, Sam Bankman-Fried resigned recently due to the company’s recent losses. The company is now initiating bankruptcy applications in the United States. The shutting down of this company has resulted in the most significant scam fraud case in crypt trading history. According to reports, millions have lost money invested within this company.

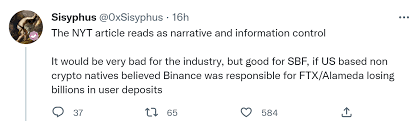

The company made the announcement of shutting down through its Twitter handle. The company was in the process of selling its shares out to other crypto trading platforms. Major crypto platforms such as Binance were in process of acquiring this company. However, Binance walked away from the proposed deal. This major incident left “Earn to give” FTX shuffling to raise about $9.4 billion from investors and rivals.

According to some other authentic sources, Bankman -Fried also had a trading firm under his own name. His firm Alameda Research is also filing for bankruptcy protection. “Earn to give” FTX claims that Alameda Research was partly behind the fall of the company. Bankman-Fried’s firm owes “Earn to give” FTX at least $10 billion.

The fall of “Earn to give” FTX has resulted in a stunning reversal of fortunes for the company and the founder. Before this, experts would consider FTX’s founder as one of the richest men in crypto. The fall of “Earn to give” FTX has raised serious concerns about the future of a few smaller firms. These smaller firms such as BlockFi, Voyager Digital, and a few others are now struggling to get investors. This is because the fall of such a huge firm has hugely affected the trust level of investors in the crypto market.

BlockFi had signed a rescue package with FTX after it was about to go out of business. However, their rescuer has gone out of business themselves. According to the company, the company’s fall came as many of the customers were withdrawing their funds at a rapid pace.